Artificial Intelligence (AI) is no longer a futuristic concept—it is a powerful tool reshaping the way finance departments operate. Across industries, companies are adopting AI-driven technologies to improve accuracy, streamline operations, and make smarter financial decisions. The impact is broad, touching everything from basic accounting to high-level financial forecasting. As AI continues to advance, finance professionals are rethinking how they approach their work and redefine their roles in an increasingly automated environment.

Finance has traditionally been dependent on manual processes, spreadsheets, and hours of human oversight. With AI now integrated into various aspects of financial workflows, that landscape is undergoing a major transformation. This post explores how AI is changing the way finance works—what tasks are being automated, what new opportunities are emerging, and how professionals can adapt in this evolving space.

AI in Finance: From Data Entry to Decision-Making

A long time ago, finance teams spent a lot of time doing the same things over and over, like matching invoices, balancing data, or keeping track of costs. These steps not only took a long time, but they were also easy for people to mess up. AI is changing that by automating basic jobs and using data analysis to help people make better decisions.

AI can process vast amounts of financial data in real-time, flag inconsistencies, detect patterns, and even suggest actions. Rather than acting as a replacement for finance professionals, AI is becoming a digital partner—taking over routine tasks so that human workers can focus on strategy and problem-solving.

Key Areas Where AI Is Making an Impact

AI is not limited to one aspect of finance. Its influence is felt across various domains, each benefiting in unique ways.

Accounting Automation

The field of accounting is one of the first to be changed by AI. Smart accounting tools can instantly sort transactions into the right category, balance accounts, make reports, and find problems. These systems keep learning from what they've been given, which makes them more accurate over time.

Finance teams benefit from reduced manual work, fewer errors, and quicker month-end closes. Tools such as optical character recognition (OCR) and natural language processing (NLP) can extract data from receipts and invoices, reducing paperwork and speeding up processing.

Financial Planning and Forecasting

AI models can analyze historical data, market trends, and external factors to deliver highly accurate financial forecasts. These models learn from both internal data (sales, budgets, performance) and external data (economic indicators, industry trends), giving businesses a deeper view of what’s ahead.

Risk Management and Compliance

AI is becoming an essential part of risk management. Financial institutions and corporate finance teams use machine learning algorithms to identify abnormal activity, detect fraud, and assess credit risk. These tools can monitor transactions and highlight suspicious behavior instantly. In terms of compliance, AI assists in reviewing documents, ensuring regulatory requirements are met, and flagging potential violations.

Fraud Detection with AI

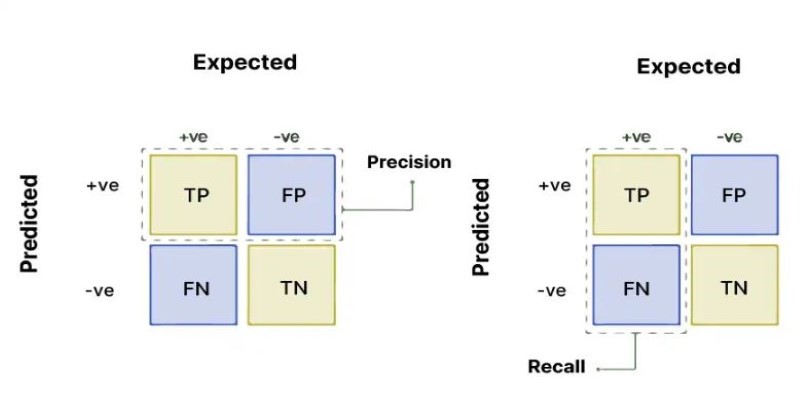

Fraud detection is one of the most critical applications of AI in finance. Traditional methods involved periodic audits or manual checks, which could miss hidden patterns. AI changes that by continuously monitoring financial transactions for anomalies.

Machine learning algorithms are trained to understand what normal behavior looks like. When something deviates—such as a sudden change in spending, unusual login activity, or duplicate invoices—the system alerts finance or security teams immediately.

Common financial fraud patterns AI can detect include:

- Sudden spikes in transaction amounts

- Unusual vendor behavior

- Fake invoices or duplicate payments

- Access from suspicious IP addresses

With AI in place, fraud risks can be identified early and addressed before causing significant damage.

The Changing Role of Finance Professionals

As AI handles more of the data-heavy tasks, finance professionals are shifting into more analytical and advisory roles. Instead of spending time entering data, they are now interpreting it, making strategic recommendations, and contributing to business growth.

Finance professionals now need to:

- Understand how AI tools generate insights

- Translate AI-driven data into business decisions

- Collaborate with tech teams to implement financial tools

- Continuously update their knowledge of AI and automation trends

Far from making finance jobs obsolete, AI is increasing the value finance professionals bring to the table—especially those who embrace technology and adapt.

Real-World Examples of AI in Finance

Several leading companies have already implemented AI in their financial workflows with significant results.

- JPMorgan Chase developed a tool called COiN that reviews commercial loan agreements in seconds—a process that previously took legal teams hundreds of hours.

- American Express uses AI to analyze customer spending patterns and detect fraud in real time, improving customer trust and reducing financial loss.

- Intuit integrated AI into its QuickBooks software to help small businesses automate expense tracking and get real-time insights into their cash flow.

These examples highlight the real-world potential of AI to improve both accuracy and efficiency in finance.

Challenges to Overcome

Despite its advantages, implementing AI in finance is not without challenges. Organizations need to ensure they are using high-quality, unbiased data. Any flaws in the input can lead to incorrect predictions or misjudged risk.

Common challenges include:

- Ensuring clean and reliable data inputs

- Protecting against data breaches

- Integrating AI with existing systems

- Building cross-functional collaboration between finance and tech teams

Companies that address these challenges proactively will have a better chance of success in their AI journey.

Conclusion

Artificial intelligence is not just a tool for automation—it’s a transformative force reshaping the finance industry. From accounting and forecasting to fraud detection and investment planning, AI is helping finance professionals do their work faster, more accurately, and more strategically. Organizations that adopt AI early are already seeing improvements in efficiency, risk management, and decision-making. For finance professionals, the key is to embrace change, learn new technologies, and use AI as a partner—not a replacement—in building smarter financial operations.